04 Nov The Stellar Rise Of Mobile-Only Banks Has Nothing To Do With Banking

Mobile-only banks, challenger banks and neobanks are inundating the financial market in a new wave of disruption. Compared to traditional (incumbent or retail) banks, mobile-only banks are flourishing at an unprecedented rate in global expansion, valuations, customer satisfaction, and, most notably, customer acquisitions.

Customers are Jumping Ship to Mobile-Only Banks

According to AT Kearney’s study, Neobanks in Europe have gained more than 15 Million customers since 2011. This number is projected to rise to 85 Million by 2023. Retail banks have already suffered a decline of 2 Million customers in the past decade, and that statistic is predicted to plummet further. Naturally, this has shaken up the banking space and forced incumbent banks to invest heavily in digital transformation, innovative partnerships and consumer win-back campaigns. As Bill Gates (in)famously put it back in the 90’s: “Banking is necessary. Banks are not.” – Bill Gates

Telco and Neobanking Synergy

Telcos are another threat to traditional banks as they steadily move into the financial sphere, launching their own particular breeds of neobanks. Orange launched a 100% mobile banking service (Orange Bank) back in 2017, which has reported a great level of growth and consumer interest since. With over a quarter of a Million customers, Orange Bank has ambitions to reach 4 million European customers within six years, by which time the mobile-only bank plans to be generating €500 million in net banking income (NBI).

The target is not unrealistic, as Orange already has access to tens of millions of existing telecom customers. The synergy between telco and finance is a very logical one on many fronts. Those customers who have both a banking and telco relationship with an operator are notably more satisfied (15% in the case of Orange), and ‘churn’ (customer turnover) goes down.

As Paul de Leusse, Deputy CEO of Orange and CEO of Orange Bank, observed in his 2019 press release: “Money has become a consumer product like any other. Customers want to regain control and are using digital tools to achieve this.” – Paul de Leusse (CEO of Orange Bank)

Value Added Services are Key to Profitability and Loyalty

There are several key driving forces behind the runaway success stories of the newest players to the banking game. Firstly, value added services. Unlike incumbent banks, dynamic neobanks have rapid innovation cycles, and frequently launch new additional services within their platform that their users love.

Mobile banks also generally win customers via a no-fees no-frills approach, which consequently means their core business does not generate significant margin. To survive, value added services are lifeblood. Inbuilt adjacent insurance offers undoubtedly have the biggest impact on profits, but also on customer loyalty. These insurances are often already part of the banks general offer, or can be purchased as add-ons.

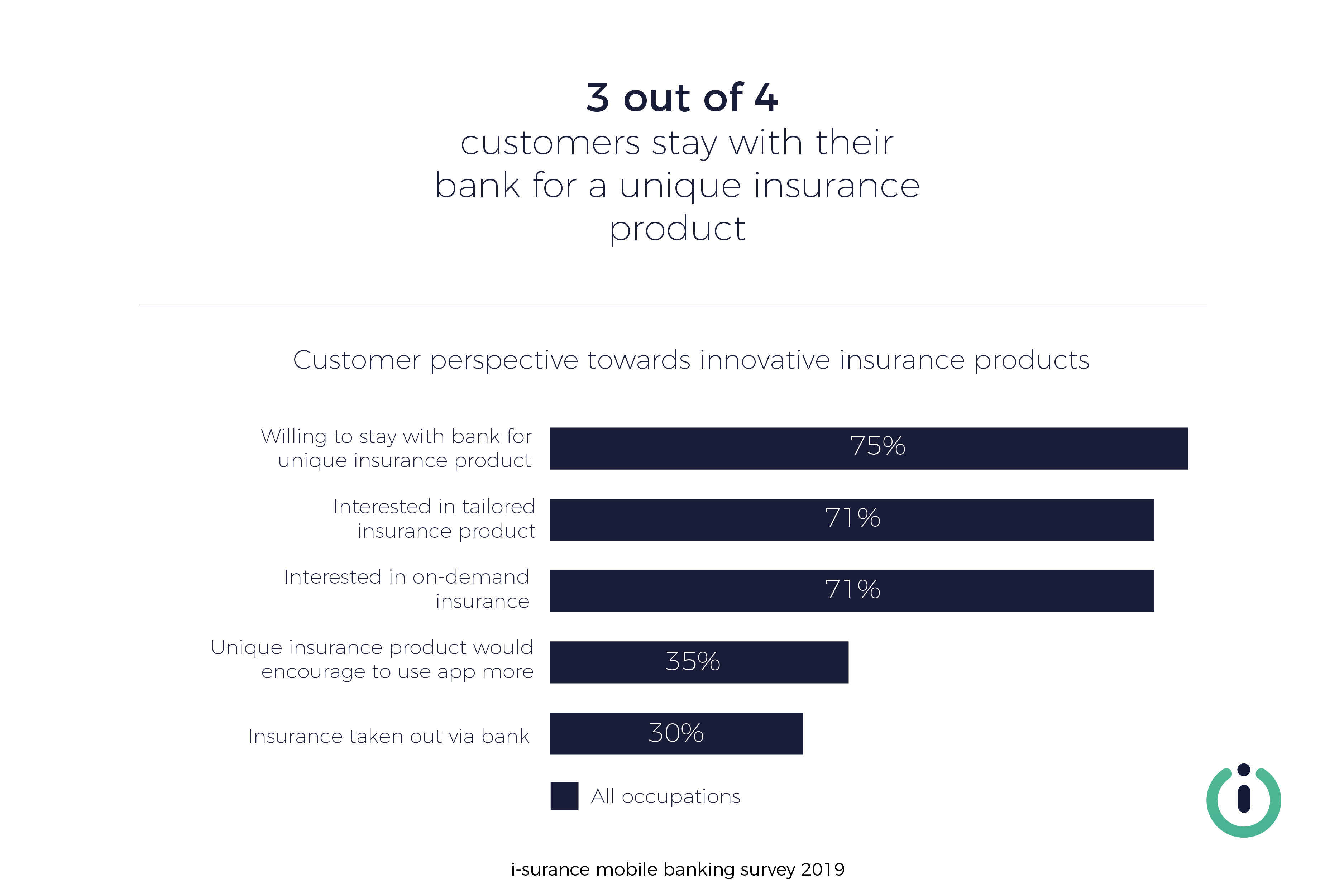

The recent European 2019 Mobile Banking Survey from i-surance highlights that a whopping three quarters of mobile banking users will stay loyal to their bank if they have the option to take out an insurance program via the app. This is a vitally important statistic for newcomer digital banks that invest heavily in holding onto customers. For the full insights of the mobile banking survey, contact i-surance here.

Three quarters of European mobile banking users will stay loyal to their bank (no matter whether they are a neobank or traditional bank) if they have the option to take out an insurance program via the app.

Source: i-surance mobile banking survey 2019. For full survey contact i-surance.

Tailored Insurance Propositions the Secret to Success of Mobile-Only Banks

The main reason insurance plans offered by mobile banks leads to success is that they are intuitively tailored to the target customer. This is in stark contrast to the types of insurances offered by the traditional banks. Incumbent banks often offer general property and health insurance but this is usually not very differentiating and successful for the bank. The main reason is a logical one, health is not intuitive to banking, so consumers don’t relate to the offer. Furthermore, the customer base of traditional banks is very varied. Neobanks that are able to partner with innovative digital insurers and target a specific niche of customers, on the other hand, have enormous success.

Several neobanks market specifically to frequent travellers, who usually seek banking apps for convenience, a fast and simple interface and decent foreign exchange rates. The dutch neobank Bunq is one of these, with their innovative travel card as their signature product. The travellers that are signing up for Bunq in droves are exactly the segment that are interested in adjacent travel insurance options. This is a sector of insurance that is booming, as we’ve covered on Telcoverager before.

Digital savvy insurtechs such as i-surance offer several kinds of travel related insurance products that are able to integrate well with neobanks, from flight delay care to passport protection to pay-per-day mobile device insurance abroad. In such a partnership, mobile-only banks are able to both tap into a profitable adjacent revenue stream and keep their customers happy.

Mobile bank users in Europe have great interest in on-demand (pay-per-day) insurance offers, especially travel insurance.

Source: i-surance mobile banking survey 2019. For full survey contact i-surance.

Simple, Digital and Customer Friendly Wins the Game

The second major key to neobank triumph is customer experience. Leading mobile banks like Revolut win customers through pure simplicity and superior customer service. It’s not only Revolut’s sign-up process that is fast; value added services are able to be contracted in mere clicks. Revolut has 8 Million customers that demand the easiest possible interface. Accordingly, Revolut has a 2-click access model for their on-demand travel insurance. This level of ease within the platform, as well as their integrated insurance product, means the company has grown into a £40 Billion finance giant in just over four years.

Clearly, all mobile-only banks should be providing insurance as a value added service, but many are still lagging behind and leaving a profitable revenue stream untapped. What’s also troubling is that a large segment of mobile bank customers are not aware of any kind of insurance offer available through their (neo)banks, even when it’s there. This highlights the need for better marketing of such a fundamental product.

Less than half of mobile-only banks offer insurance as an adjacent service, even though it would encourage over a third of their users to use their app more.

Source: i-surance mobile banking survey 2019. For full survey contact i-surance.

The New Era of Banking

Neobanks are already on an explosive growth trajectory, leaving traditional banks floundering in their wake. The key to the rise of mobile-only banks, to quote Valentin Stalf, CEO of N26, during Disrupt Berlin 2017: “In the end, it’s about winning customers from traditional banks” – Valentin Stalf (CEO of N26)

The final push that encourages customers to make that leap is value added services, especially having insurance options. i-surance provides highly tailored propositions to neobanks, challenger banks and mobile-only banks based on the bank’s customer niche, such as on-demand travel insurance in 2 clicks. Partnering with an innovative and experienced insurance provider such as i-surance lets neobanks concentrate on what they do best – disrupting banking for good.

No Comments